Thousands of assets now supported by WOOFi’s cross-chain swaps

Swap any tokens seamlessly across Ethereum, Arbitrum, Avalanche, Optimism, Polygon, Linea, Base, and BNB Chain - exclusively with WOOFi

More assets, less headache

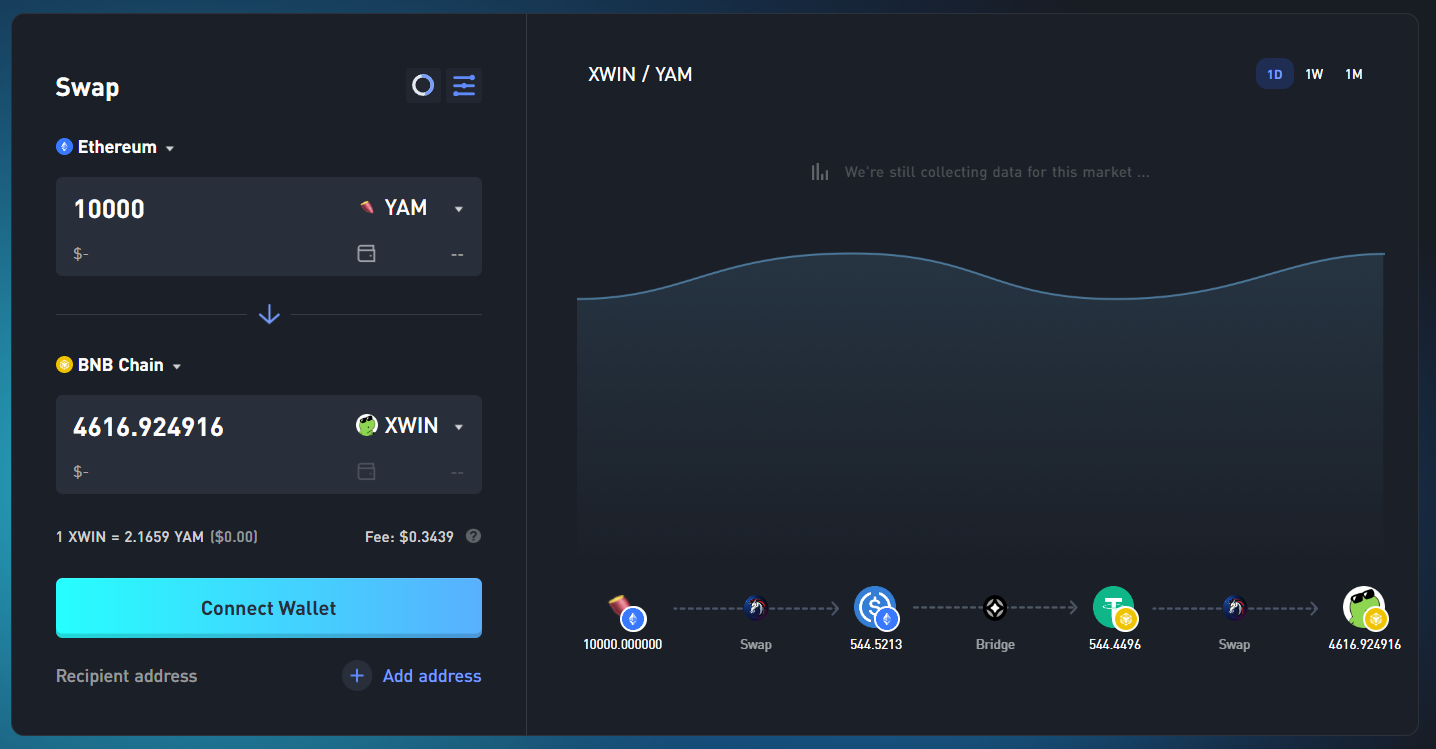

DeFi’s most efficient cross-chain DEX just got an upgrade. WOOFi’s unbeatable UI/UX is now leveraging leading DEX aggregator 1inch’s routing algorithm to enable anyone to cross-chain swap any tokens across 8 major EVM chains. You heard me - the days of WOOFi being confined to just blue-chip assets are behind us, and an exciting new world of infinite swapping possibilities is at hand.

How about a ridiculous example? Imagine you own $NEU (a $355k MC token with a 24-hour volume of $750) on Arbitrum and you want to 1) dump it, 2) bridge those stables into Ethereum and 3) buy any other coin. WOOFi now facilitates this in one single transaction, and not just for Arbitrum and Ethereum, but for every popular EVM chain. Let me rehash that once more. No matter the tokens you want to swap, or the chains you want to swap them across, WOOFi can get the job done.

Will all my swaps now be routed through 1inch? Not quite. Think of it like this: if WOOFi’s CeFi-grade liquidity can execute your swap, it will. If it can’t, it will find the best protocol that can. And don’t worry, if it’s just a simple swap i.e. AVAX for JOE on Avalanche, WOOFi won’t add any extra fees to ensure you get the best bang for your buck. Forget about going elsewhere, WOOFi is now your one-stop shop for swaps.

More revenue, more happy stakers

For facilitating cross-chain swaps between any tokens, WOOFi will charge its trademark 0.025% fee. As is the case for all volume passing through WOOFi, 80% of the fees will be given to WOOFi stakers in addition to all revenue they already receive, claimable in either WOO tokens or USDC.

More reasons to make WOOFi your home

Before today, WOOFi was already a core cross-chain destination in DeFi, but today’s upgrade takes its utility to an entirely new level. With the addition of more chains on the horizon too, WOOFi users will soon be able to cross-chain swap any token across any layer 2, uniting what is now a deeply fragmented and disconnected space under one roof with one simple, clean, and intuitive UI. For now, though, we urge you to visit WOOFi and experience this mega upgrade!

The content above is neither a recommendation for investment and trading strategies nor does it constitute an offer, solicitation, or recommendation of any product or service. The content is for informational sharing purposes only. Anyone who makes or changes the investment decision based on the content shall undertake the result or loss by himself/herself.

The content of this document has been translated into different languages and shared throughout different platforms. In case of any discrepancy or inconsistency between different posts caused by mistranslations, the English version on our official website shall prevail.