Narrative vs Liquidity: What drove BTC back to $100K?

By Pat Zhang

For cryptocurrency traders, one of the most anticipated policies after Donald Trump’s election was the potential adoption of Bitcoin as a strategic reserve for the US government. However, three months after the election, there has been little action from the federal government. Does this mean the hope for a Bitcoin reserve has faded? Not necessarily. In fact, within just one week, two US states—New Hampshire and Arizona—have officially added Bitcoin to their state treasuries, with five more states discussing similar moves. However, the key question remains: Was Bitcoin’s rise back to $100K driven by real liquidity, or was it just fueled by the narrative?

A closer look at the funding sources, allocation limits, and custody models reveals significant differences, reflecting varying tolerance levels among local governments for "highly volatile, decentralized assets." This article critically examines who is genuinely building, who is engaging in political theatrics, and where the potential black swan risks lie, while predicting the next market impacts of this "official HODL" trend on liquidity and narrative premiums.

How are New Hampshire and Arizona approaching it?

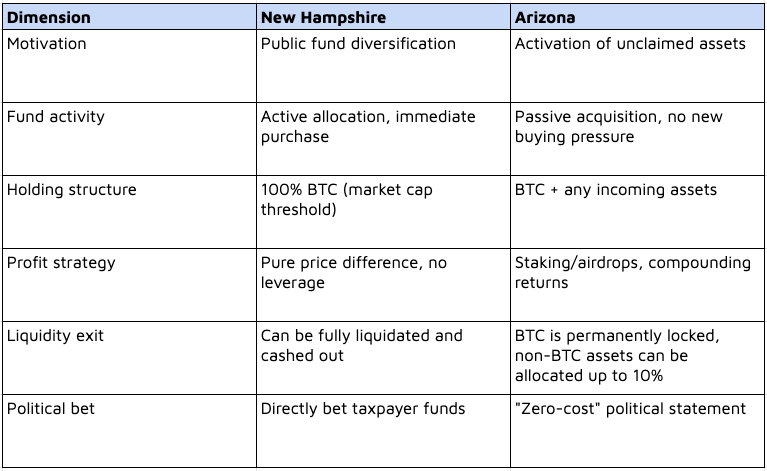

In just 48 hours, New Hampshire and Arizona passed legislation and received gubernatorial approval, marking the beginning of state treasuries holding Bitcoin. The two states have adopted drastically different paths and risk control mechanisms, revealing the trade-offs driven by their distinct political and economic goals.

New Hampshire HB 302 | active allocation, single-asset BTC, sets a cap

New Hampshire’s approach resembles "Treasury-level asset diversification." The bill authorizes the state treasurer to convert up to 5% of the general and rainy-day funds into digital assets with a market cap consistently above $500 billion for one year, effectively limiting it to Bitcoin.

Legislators emphasize the 5% cap as a safeguard: if the financial pool grows or shrinks, the holding limit adjusts accordingly, avoiding heavy exposure. However, the bill is unclear on whether the state would be forced to proportionally sell if the fund size decreases, leaving a gray area in accounting.

For custody, HB 302 offers three options:

- Self-managed multi-signature cold wallet;

- Custody by a licensed "Special Purpose Depository Institution (SPDI)" or another regulated bank;

- Holding via a Bitcoin ETF approved by the SEC or NFA.

If choosing the cold wallet, the state must meet seven technical standards, including geographic distribution, hardware isolation, and annual penetration testing to minimize the risk of private key leakage. However, opting for an ETF means the state only receives a trust certificate, which contrasts with the blockchain's transparency and traceability advantages.

Regarding information disclosure, the state treasurer must report holdings, costs, and unrealized gains or losses quarterly. Supporters of the bill have verbally committed to publishing the on-chain address for added transparency, though this is not a mandatory provision. The bill also bans leverage, lending, or collateralization to eliminate credit risk, at the cost of foregoing any yield-enhancement strategies.

New Hampshire’s approach is one of "Treasury-level asset diversification": a small, single-asset, highly conservative strategy, yet it directly ties taxpayers to the volatile Bitcoin price.

Arizona HB 2749 | Passive acquisition, no tax liability, allows staking

Arizona's core selling point is "no tax burden." The new law allows the state government to transfer unclaimed crypto assets (including those with partial or damaged private keys) into a newly established "Bitcoin and Digital Asset Reserve Fund" after a three-year search period. The fund can also legally accept all airdrops and staking rewards, creating a compounding cycle without needing additional budget from the legislature.

A bolder aspect is the scope of assets, with no market cap or liquidity threshold specified. Any asset the state obtains, from Bitcoin to low-volume meme coins, can be added to the fund. This diversification helps mitigate risk but also exposes the state to potential price manipulation in smaller coins.

Custody must be handled by licensed and compliant institutions in Arizona. The assets can participate in full-chain staking to earn rewards, making the state treasury an active on-chain player. However, if a validator is slashed or a smart contract fails, the loss falls on the public sector.

In terms of liquidity management, HB 2749 allows the state treasurer to convert up to 10% of non-Bitcoin holdings into cash to subsidize general fund expenses. The Bitcoin portion is legislatively locked and cannot be accessed unless new legislation is passed. Information disclosure requires an annual report and legislative approval for fund usage, but there is no mandatory on-chain address transparency, making it less transparent than decentralized standards.

Arizona treats Bitcoin as "found money that earns interest," using staking and airdrops to amplify idle value while cleverly avoiding taxpayer scrutiny. However, this places the state treasury on the front lines of on-chain operational risks.

What could traders pay attention to?

- Buying Scale: Even if fully allocated, New Hampshire’s impact is limited at $300-400 million, with minimal effect on BTC liquidity; Arizona’s initial impact is even smaller.

- Narrative Boost: Official backing and the "no tax burden" story may drive short-term sentiment, but cash flow won't immediately follow.

- Risk Control Comparison: New Hampshire’s "cap + cold wallet" approach yields low returns; Arizona’s "no-cost staking" introduces high technical/contract risks. Neither model is a catch-all solution.

- Black Swan: If BTC drops by more than 20% in a single day, New Hampshire could face forced markdowns due to accounting; Arizona would face risks from staking slashing or custody issues, which could lead to opposition in the state legislature.

Core difference analysis

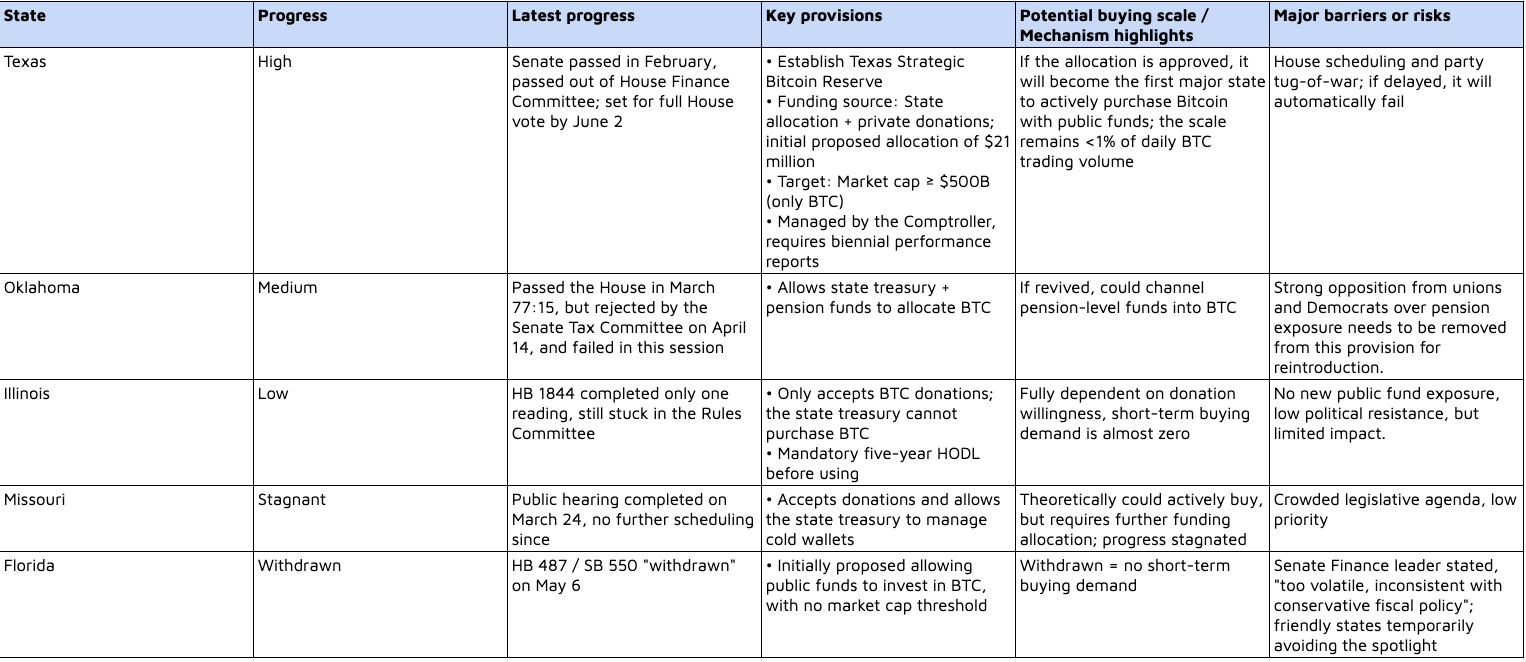

What about other states?

- The key is in Texas: If the bill is successfully scheduled and funded by June 2, it will mark the first "large-scale public fund Bitcoin purchase" case, and the narrative will be amplified. On the contrary, if Texas encounters obstacles, it will be even harder for subsequent states to mobilize.

- Buying doesn’t equal legislation: Even if the bill passes, the budget allocation still requires separate approval; investors should continue to monitor the allocation bill and on-chain wallet address disclosures.

- Significant differences in provisions: From Texas' "active allocation + single BTC bet" to Illinois' "pure donations + five-year lock-up," the risk/reward profiles vary greatly. Subsequent states may mix and match the best features.

Does buying pressure have real effects? It's mainly sentiment-driven.

New Hampshire allows the state treasury to convert up to 5% of its general and rainy-day funds into Bitcoin. With the state's fiscal budget under $7 billion, even if fully allocated, this would amount to only $300-400 million. Arizona, on the other hand, has adopted a policy to "passively acquire" unclaimed crypto assets held for more than three years, but in the short term, it's unlikely to even reach hundreds of millions. In contrast, Bitcoin's 24-hour spot trading volume consistently maintains $60-70 billion, meaning even if state governments enter the market in bulk, they would only account for less than 0.1% of daily market liquidity. The legislative discussions are louder than the actual funds being allocated; price movements are more driven by sentiment rather than an imbalance in spot supply and demand.

The bills from the two states were signed on May 6 (NH) and May 8 (AZ). Over a 48-hour period, Bitcoin rose from $96K to nearly $100K, with a weekly increase of about 3%. According to Axios, the volume of social media discussions related to the keyword "Bitcoin Reserve" grew by over 240% in the same period. However, trading volume did not increase in parallel, pointing to a "headline rally" rather than significant spot absorption.

Additionally, Glassnode notes that the 30-day annualized volatility has fallen back to 45-50%, the lowest range since 2021, though historically, it has typically been above 60%, making it still incomparable to traditional assets. If a Black Swan event leads to a price drop greater than 20% in a single day, New Hampshire’s 5% holding would immediately face markdown pressure, and Arizona would also bear the extra risk of stake slashing or custodial contract errors.

The official HODL narrative has already been partially priced in by the market. What truly determines the market trend is the speed of legislative implementation and the actual amount of fiscal allocation. Only when legislation, funding allocation, and on-chain wallet addresses are all in place can we attribute the rise in Bitcoin prices to the state strategic reserves.

Final thoughts: Liquidity or narrative?

While the recent state-level initiatives may drive significant media attention, the impact on Bitcoin’s liquidity remains limited for now. The rise in Bitcoin prices back to $100K seems to be more about the narrative of state governments entering the space rather than real liquidity injections. However, as these policies evolve and more states potentially follow suit, the balance between narrative and liquidity could shift. For now, the market is pricing in the "official HODL" story—yet, it remains to be seen whether this narrative will have lasting effects or whether true liquidity-driven demand will take center stage in the next market cycle.

Disclaimer

The information provided in this article is for general informational purposes only and does not constitute financial, investment, legal, or professional advice of any kind. While we have made every effort to ensure that the information contained herein is accurate and up-to-date, we make no guarantees as to its completeness or accuracy. The content is based on information available at the time of writing and may be subject to change.

This article may include statements, opinions, or insights from third parties, including individuals from other companies or organizations. Any such statements are solely those of the respective individuals or entities and do not necessarily reflect our views, opinions, or positions. We do not endorse, verify, or assume any responsibility for the accuracy, reliability, or completeness of any third-party statements or information referenced in this article.

Please note that this article might include references to third-party websites and data provided solely for convenience and informational purposes. We do not endorse or assume any responsibility for the content, accuracy, or reliability of any information, products, or services offered by third parties.

All market prices, data, and other information (including that which may be derived from third-party sources believed to be reliable) are not warranted as to completeness or accuracy and are subject to change without notice. WOO disclaims any responsibility or liability to the fullest extent permitted by applicable law, whether in contract, tort (including, without limitation, negligence), equity or otherwise, for any loss or damage arising from any reliance on or the use of this material in any way. The information contained herein is as of the date and time referenced only, and WOO does not undertake any obligation to update such information.

Cryptocurrencies involve significant risk and may not be suitable for all investors. The value of digital currencies can be extremely volatile, and you should carefully consider your investment objectives, level of experience, and risk appetite before participating in any staking or investment activities.

We strongly recommend that you seek independent advice from a qualified professional before making any investment or financial decisions related to cryptocurrencies.. We shall in NO case be liable for any loss or damage arising directly or indirectly from the use of or reliance on the information contained in this article.